Akamai Reports Second Quarter 2001 Results

- Second quarter revenue of $43.1 million, up over 137% from

same period last year

- EBITDA loss continues to narrow to $26.5 million from $36.5

million in previous quarter

- Capital expenditures continue to decline to $18.2 million from

$24.5 million in previous quarter

- Network reaches new milestone, growing to over 11,600 servers

inside more than 820 networks in 62 countries

Akamai Technologies, Inc. (NASDAQ:AKAM), the leading provider of distributed

application and content delivery services, today reported financial results for

the second quarter ended June 30, 2001. Revenue for the quarter was $43.1

million, compared to revenue of $40.2 million for the previous quarter, and

represents a 137.8% increase compared to revenue of $18.1 million for the second

quarter of 2000.

"Akamai recorded another quarter of solid growth and progress toward reaching our goal of being EBITDA positive by the second quarter of next year," said George Conrades, chairman and CEO of Akamai. "As we continue to build revenue and manage our costs, Akamai is demonstrating that our recurring revenue and low capital expenditure business model works and supports our fully-funded business plan."

Second quarter earnings before interest, taxes, depreciation, amortization and other one-time and non-cash charges (EBITDA) was a loss of $26.5 million, lower than the first quarter 2001 EBITDA loss of $36.5 million.

Normalized net loss for second quarter 2001, before amortization and other one-time and non-cash charges, totaled $46.8 million, or $0.46 per share, compared to First Call's consensus summary net loss of $0.50 per share. First quarter 2001 normalized net loss was $52.5 million, or $0.53 per share.

Net loss, in accordance with GAAP, for second quarter 2001 was $92.6 million, or $0.91 per share. This includes a restructuring charge of $26.2 million related to a workforce reduction and excess real estate, equity-related compensation of $11.0 million, and other non-cash charges of $8.6 million.

Second Quarter 2001 In Review:Financials. "We delivered the numbers in a challenging macro environment. Revenue and gross profit are up, and operating expenses and capital expenditures have continued to drop as a percentage of revenue," said Timothy Weller, CFO of Akamai. "Our fully-funded business plan is now a strategic weapon in the marketplace, as enterprise customers seek long-term partnerships with us. Our DSO of 52 days testifies to the quality of that customer base."

At June 30, 2001, the Company had $267.1 million of cash, cash equivalents, and short-term and long-term marketable securities as compared to $313.1 million at March 31, 2001. Capital expenditures, principally made in connection with network deployment, facilities and information systems, for the quarter were $18.2 million, down from $24.5 million in the previous quarter. At June 30, 2001, the Company had 115.1 million shares of common stock outstanding. At June 30, 2001, common stock outstanding and unexercised stock options and warrants totaled 125.5 million shares.

Customers. At the end of the second quarter of 2001, Akamai's customer base under recurring contract totaled 1,333. Customer highlights included strong sales of Akamai's EdgeSuite(SM) service to such businesses as Novartis, a world leader in healthcare, BestBuy.com, a consumer goods retailer, and Victoria's Secret, a leading clothing retailer, to name a few. Akamai ended the quarter with over 50 EdgeSuite customers under long-term contracts, and many more undergoing technical trials, compared to 17 EdgeSuite customers at the end of the previous quarter.

"Our customers are realizing that Akamai's EdgeSuite service not only reduces the costs associated with running a mission-critical Website, but it also offers a uniform architecture on which enterprises can produce Web-based applications that perform with improved reliability, lower overall costs, and higher revenues," Conrades said. Akamai's EdgeSuite service is an integrated set of functionalities designed to reduce Internet infrastructure costs and complexities by extending the performance, scalability, and reliability benefits of content delivery across an entire Web site.

Akamai added several new EdgeSuite resellers including EDS, IBM, Inflow and XO Communications. Other resellers of Akamai's services announced during the quarter include Depicta, Digital Wave, and ReleaseNow, as well as streaming provider ON24. Akamai's indirect channels contributed 22% of second quarter revenue.

Network. Akamai achieved an important milestone in the quarter by surpassing the 10,000-server mark, extending the company's distributed network to include 11,689 servers, up from 9,743 in the first quarter. Akamai's servers are now deployed within more than 820 networks in 62 countries, including Internet backbone providers, ISPs, cable and DSL providers, and other telecommunications facilities.

Technology. Akamai extended its global platform with several key technology milestones in the second quarter, including the development and delivery of Edge Side Includes (ESI), an open specification for dynamic assembly of Web pages at the edge of the Internet. As part of the first technology relationship based on ESI, Akamai announced interoperability between the Oracle9i Application Server and Akamai's EdgeSuite service to enable companies to develop and deploy dynamic Web sites and applications. ESI, co-authored by Akamai, also received widespread industry recognition by leaders in the application server, content infrastructure, content management system, and content delivery network (CDN) space. With ESI, companies can reduce the complexity and infrastructure requirements of developing, deploying and maintaining highly scalable and reliable Web sites and Web-based applications.

Akamai's EdgeScape(SM) service, enabling content customization through geo-location and bandwidth characterization, gained significant traction during the quarter, including adoption by Yahoo! to enhance the Web portal's customized ad targeting capabilities.

Akamai introduced SiteWise, a new service that provides real-time Web reporting and analysis for business decision makers, including marketing executives, Internet business managers, Web developers, and IT professionals, to maximize the effectiveness of their Web campaigns and measure the results of their e-business efforts.

Quarterly Conference CallAkamai will host a conference call to discuss second quarter 2001 results today at 4:30 PM Eastern Time. A live Webcast of Akamai's conference call can be accessed at www.akamai.com. In addition, a replay of the call will be available for 48 hours following the conference call and can be accessed through the Akamai Website or by calling 800-274-4379 (or 1+706-634-7028 for international calls) and using conference ID No. 12495.

About AkamaiAkamai is the leading provider of distributed application and content delivery services. These services enable companies to reduce the complexity and cost of deploying and operating a uniform Web infrastructure while ensuring unmatched performance, reliability, scalability and manageability. Akamai's services give businesses a distinct competitive advantage and provide an unparalleled Internet experience for their customers. Akamai's intelligent edge platform for content, streaming media, and application delivery comprises more than 11,600 servers within over 820 networks in 62 countries. With headquarters in Cambridge, Massachusetts, Akamai provides services to companies worldwide. For information on Delivering a Better Internet(SM), visit www.akamai.com.

Akamai Statement Under the Private Securities Litigation Reform Act

The release contains information about future expectations, plans and prospects of Akamai's management that constitute forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by these forward-looking statements as a result of various important factors including, but not limited to, general economic conditions, any material, unexpected increases in Akamai's use of funds, the dependence on Akamai's Internet content delivery service and technology products, lack of market acceptance of new services, a failure by us to successfully enter into any license, technology development or other technology partnership agreement within the time periods expected by us or at all, a failure of Akamai's network infrastructure, and other factors that are discussed in the Company's Annual Report on Form 10-K, quarterly reports on Form 10-Q, and other documents periodically filed with the SEC.

Copyright (c) 2001 Akamai Technologies, Inc. All Rights Reserved. Akamai, EdgeSuite, FreeFlow, Delivering a Better Internet, EdgeAdvantage, and the blue multi-wave logo are all trademarks or registered trademarks of Akamai Technologies. All other company and product names referenced herein are the trademarks or registered trademarks of their respective holders.

Akamai Technologies, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

June 30, December 31,

2001 2000

---------- -----------

Assets

Current assets:

Cash, cash equivalents and

short-term marketable securities $ 267,103 $ 309,652

Accounts receivable, net 25,226 22,670

Prepaid expenses and other current assets 18,495 23,022

---------- ----------

Total current assets 310,824 355,344

Property and equipment, net 150,824 143,041

Goodwill and other intangible assets, net 30,811 2,186,157

Marketable securities -- 77,282

Other assets 27,136 28,953

---------- ----------

Total assets $ 519,595 $2,790,777

========== ==========

Liabilities and stockholders' equity

Current liabilities:

Accounts payable and accrued expenses $ 71,116 $ 79,481

Other current liabilities 14,895 5,467

---------- ----------

Total current liabilities 86,011 84,948

Long-term liabilities 316,543 301,430

---------- ----------

Total liabilities 402,554 386,378

Stockholders' equity 117,041 2,404,399

---------- ----------

Total liabilities and stockholders' equity $ 519,595 $2,790,777

========== ==========

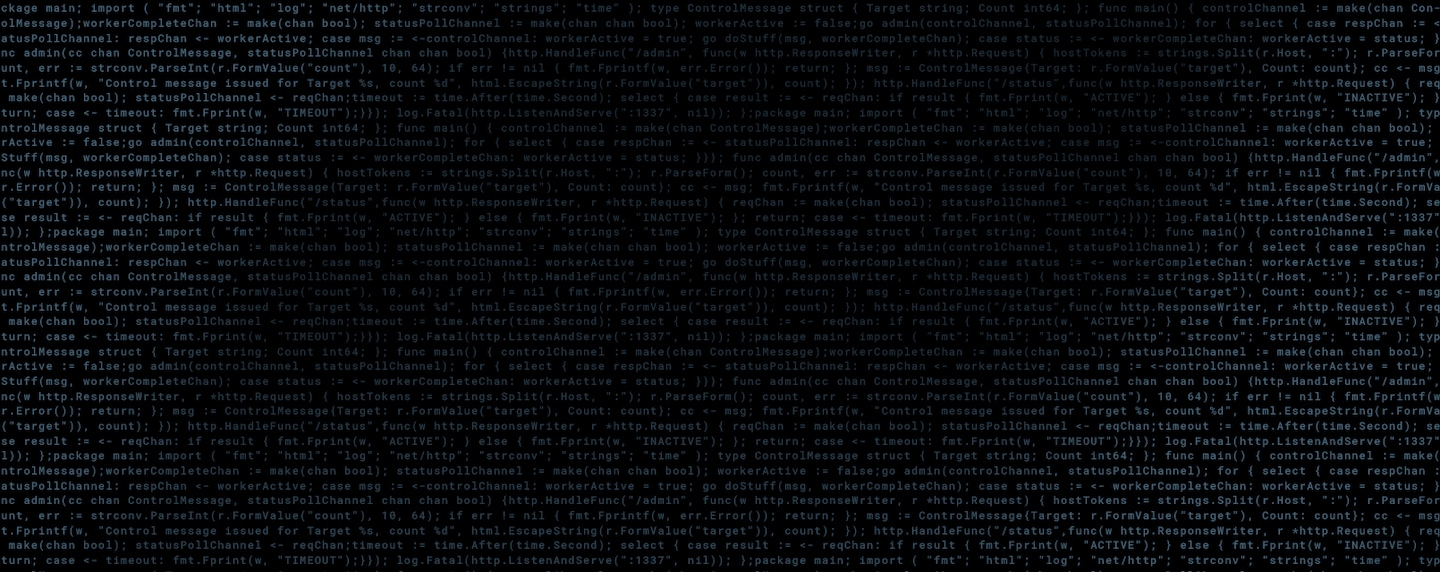

Akamai Technologies, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

For the For the For the For the For the

three three three three three

months months months months months

ended ended ended ended ended

June 30, March 31, Dec. 31, Sept. 30, June 30,

2001 2001 2000 2000 2000

-------- ----------- --------- --------- ---------

Revenue $ 43,141 $ 40,209 $ 37,244 $ 27,156 $ 18,144

Cost of service

(before

network-related

depreciation) 13,622 16,160 16,264 12,056 8,631

-------- ----------- --------- --------- ---------

Gross profit 29,519 24,049 20,980 15,100 9,513

Gross margin % 68.4% 59.8% 56.3% 55.6% 52.4%

Operating Expenses:

Engineering

and development 16,737 18,632 17,408 18,352 12,931

Sales,

general and

administrative 39,279 41,885 48,679 41,118 35,589

Amortization of

CNN advertising 2,013 391 2,628 3,745 784

Amortization of

goodwill and

other intangible

assets 5,392 238,938 239,329 238,700 190,452

Depreciation 18,340 16,452 14,006 11,211 7,305

Equity related

compensation 11,038 4,514 4,884 9,653 9,421

Restructuring

charge 26,194 -- -- -- --

Impairment of

goodwill -- 1,912,840 -- -- --

-------- ----------- --------- --------- ---------

Total

operating

expenses 118,993 2,233,652 326,934 322,779 256,482

-------- ----------- --------- --------- ---------

Operating loss (89,474) (2,209,603) (305,954) (307,679) (246,969)

Interest income

(expense), net (1,637) 581 2,932 3,624 3,803

Equity in

losses of

affiliates (153) (1,847) -- -- --

Loss on

investments (1,000) (11,747) -- -- --

-------- ----------- --------- --------- ---------

Loss before

provision for

income taxes (92,264) (2,222,616) (303,022) (304,055) (243,166)

Provision for

income taxes 344 164 55 20 70

-------- ----------- --------- --------- ---------

Net loss $(92,608)$(2,222,780)$(303,077)$(304,075) $(243,236)

======== =========== ========= ========= =========

Basic and

diluted net

loss per share $ (0.91)$ (22.50)$ (3.16)$ (3.27) $ (2.78)

Weighted average

common shares

outstanding 101,629 98,780 95,970 93,099 87,374

Supplemental

Financial Data

(dollars and

shares in

thousands):

Normalized

net loss(1) $(46,818)$ (52,503)$ (56,236)$ (51,977)$ (42,579)

Normalized basic

and diluted

net loss

per share $ (0.46)$ (0.53)$ (0.59)$ (0.56)$ (0.49)

EBITDA(2) $(26,497)$ (36,468)$ (45,107)$ (44,370)$ (39,007)

Network-related

depreciation $ 10,276 $ 9,312 $ 7,773 $ 6,126 $ 4,016

Other depreciation$ 8,064 $ 7,140 $ 6,233 $ 5,085 $ 3,289

Capital

expenditures $ 18,245 $ 24,494 $ 35,201 $ 40,457 $ 33,537

End of period statistics:

Number of

customers

under recurring

contract 1,333 1,473 1,337 1,115 895

Number of

employees 1,129 1,299 1,299 1,229 1,063

Number of

servers 11,689 9,743 8,004 6,060 4,250

Common stock

outstanding 115,071 109,215 108,203 107,298 105,873

Common stock

outstanding and

unexercised

options

and warrants 125,470 127,372 125,413 125,292 123,187

(1) Normalized net loss (net loss before amortization and other

one-time and non-cash charges) is calculated as EBITDA less net

interest expense, provision for income taxes and depreciation.

(2) EBITDA (earnings before interest, taxes, depreciation,

amortization and other one-time and non-cash charges) is

calculated as gross profit less engineering and development

expenses and sales, general and administrative expenses.

CONTACT: Akamai Technologies

Jeff Young

Media Relations

617-250-3913

jyoung@akamai.com

or

Akamai Technologies

Steven J. Wolfe

Investor Relations

617-250-4724

swolfe@akamai.com